Economic cycles, also known as business cycles, represent the natural fluctuations in economic activity over time. These cycles consist of four key phases: Boom, Recession, Slump, and Recovery. Each phase affects businesses and consumers differently, offering unique challenges and opportunities.

I extend my sincere gratitude and acknowledgment to Dr. Bilal Aziz, from the Institute of Business & Management (IB&M), UET Lahore, for his invaluable assistance and insights in shaping this knowledge. His expertise in Economics has greatly enriched the content, making it more relevant to contemporary economic practices. This acknowledgment also highlights his continuous contributions to promoting awareness and fostering meaningful discourse on Corporate Social Responsibility (CSR), benefiting both the student and professional community.

For detail pl review the post

1. What Are Economic Cycles?

Economic cycles reflect the rise and fall in economic activity, measured primarily through Gross Domestic Product (GDP) growth. They are influenced by macroeconomic factors like consumer spending, employment rates, and government policies. These cycles are vital for businesses, investors, and policymakers to understand and navigate economic fluctuations effectively.

Common Terms Used to Discuss Economic Cycles

To better understand economic cycles, it’s useful to familiarize yourself with terms often used in discussions:

- GDP (Gross Domestic Product): The total economic output of a country, indicating growth or contraction.

- GNP (Gross National Product): Includes income earned by residents abroad and excludes foreign income within the country.

- Economic Upturn/Downturn: Used to describe phases of growth or contraction in the cycle.

- Bull Market/Bear Market: Terms from the financial market, often tied to the boom and recession phases, respectively.

- Inflation/Deflation: Rising or falling prices, often reflecting demand-supply dynamics in different phases.

- Macroeconomic Fluctuations: A broader term for describing changes in economic activity.

Phases of Economic Cycles

1. Boom Phase

Also Known As: Expansion phase, economic upturn, or growth phase.

- Characteristics:

- Rapid GDP growth (Gross Domestic Product).

- High consumer confidence and spending.

- Low unemployment as businesses growA

- Rising inflation due to demand outpacing supply.

- Implications for Businesses:

- Opportunities: Higher revenues and market expansion possibilities.

- Challenges: Resource shortages, high costs, and inflation management.

- Strategic Actions:

- Invest in capacity expansion and innovation.

- Monitor resource utilization to avoid overheating.

Examples:

- A bakery benefits from a festival season by increasing production and prices, while hiring temporary staff to meet demand. - The tech boom of the late 1990s saw companies like Microsoft rapidly grow by innovating and responding to high consumer demand.

2. Recession Phase

Also Known As: Contraction phase or downturn.

- Characteristics:

- Negative GDP growth for two consecutive quarters.

- Rising unemployment and declining consumer confidence.

- Reduced demand for goods and services.

- Implications for Businesses:

- Opportunities: Counter-cyclical industries (e.g., discount retail) often thrive as consumers seek affordable options.

- Challenges: Falling revenues, cost-cutting, and the risk of downsizing.

- Strategic Actions:

- Focus on cost efficiency and maintaining liquidity.

- Diversify into recession-resilient markets.

Examples:

- A local grocery store offers discount bundles to attract budget-conscious customers. - During the 2008 global financial crisis, companies like Walmart thrived as customers prioritized low-cost options, solidifying Walmart’s position in the market.

3. Slump Phase

Also Known As: Depression, severe downturn, or prolonged recession.

- Characteristics:

- Prolonged and severe economic contraction.

- High unemployment and drastically low consumer spending.

- Excessive spare capacity and idle resources.

- Implications for Businesses:

- Opportunities: Acquire distressed assets or consolidate operations.

- Challenges: Survival becomes the primary focus as businesses face liquidity issues.

- Strategic Actions:

- Streamline operations and cut costs where necessary.

- Invest in long-term restructuring for eventual recovery.

Examples:

- A family-owned clothing store moves to e-commerce during a slump to reduce operating costs and maintain sales. - During the Great Depression of the 1930s, General Motors restructured its operations to enhance efficiency and prepared for future growth when the economy rebounded.

4. Recovery Phase

Also Known As: Economic revival, upturn, or rebound.

- Characteristics:

- Positive GDP growth resumes after a slump or recession.

- Gradual improvement in employment and consumer confidence.

- Increased business investment and demand.

- Implications for Businesses:

- Opportunities: Expand operations and capture rising demand.

- Challenges: Sustain growth while addressing inefficiencies left over from the downturn.

- Strategic Actions:

- Capitalize on growth opportunities through innovation.

- Strengthen resilience to prepare for future economic cycles.

Examples:

- A café reintroduces its full menu and rehires staff to attract customers as the economy improves. - Post-COVID-19, companies like Zoom transitioned from crisis-driven growth to sustainable innovation, launching new features and refining pricing models.

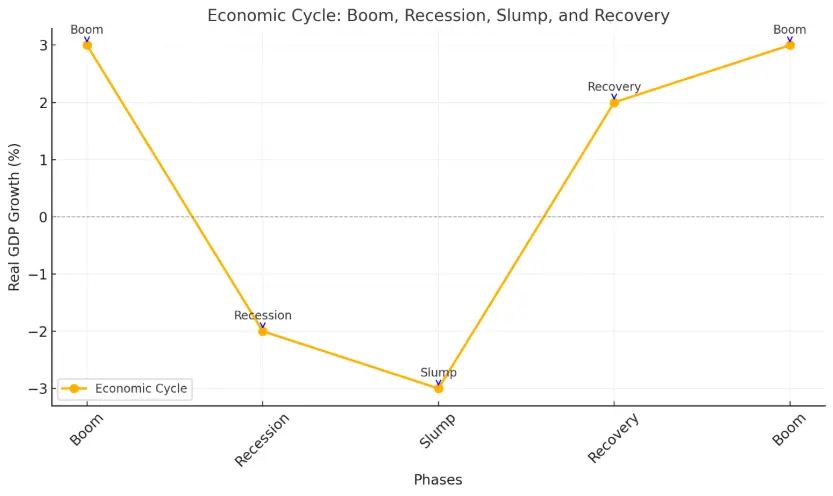

Visual Representation of Economic Cycles

The cycle can be depicted as a wave with real GDP growth on the Y-axis and time on the X-axis:

- Boom: The crest of the wave.

- Recession: Downward slope following the crest.A

- Slump: The trough of the wave.

- Recovery: Upward slope leading back to the crest.\

Comparison Phases of Economic Cycles

| Aspect | Boom | Recession | Slump | Recovery |

|---|---|---|---|---|

| Also Known As | Expansion, growth. | Contraction, downturn. | Depression, severe downturn. | Revival, rebound. |

| GDP Growth | High and positive. | Negative. | Very negative or stagnant. | Positive but moderate. |

| Unemployment | Low. | Rising. | Very high. | Falling. |

| Consumer Confidence | High. | Declining. | Very low. | Increasing. |

| Business Confidence | High. | Falling. | Very low. | Rising. |

| Inflation | Rising. | Stabilizing or decreasing. | Very low or deflationary pressures. | Moderate. |

| Resource Utilization | Overutilized; shortages possible. | Underutilized. | Excessive spare capacity. | Gradually improving. |

| Key Challenges | Managing inflation and shortages. | Declining sales and layoffs. | Survival and liquidity. | Sustaining balanced growth. |

| Opportunities | Expand and innovate. | Focus on efficiency. | Restructure for long-term gains. | Invest in growth and innovation. |

Classification of Economic Cycles

Economic cycles can be broadly classified into two main types based on their duration and underlying causes:

1. Short-Term Cycles

Short-term cycles are fluctuations in economic activity that occur over a few years and are primarily driven by demand-supply imbalances. These cycles are influenced by changes in consumer behavior, market demand, and government policies aimed at stabilizing the economy.

- Key Characteristics:

- Typically last 2 to 10 years.

- Often linked to business cycles involving production, consumption, and inventory adjustments.

- Closely tied to monetary and fiscal policy changes, such as interest rate adjustments or stimulus measures.

- Examples:

- The Dot-com Boom and Bust (1990s-2000s): A short-term cycle caused by speculative investment in internet-based companies, followed by a sharp contraction when these companies failed to deliver expected returns.

- Seasonal Retail Cycles: Retail businesses often experience short-term economic cycles around holiday seasons, such as the increase in sales during Christmas followed by a lull in January.

- Impact on Businesses:

- Businesses may adjust inventory, pricing, and hiring to manage short-term fluctuations.

- Counter-cyclical strategies, such as offering discounts during low-demand periods, help mitigate risks.

2. Long-Term Cycles

Long-term cycles, also known as structural or secular cycles, span decades and are driven by fundamental changes in the economy. These cycles often result from major technological advancements, demographic shifts, or significant global events.

- Key Characteristics:

- Typically last 20 to 50 years or more.

- Associated with transformative changes in industries, technologies, and global markets.

- Involve gradual but profound economic impacts that reshape how economies function.

- Examples:

- he Industrial Revolution (18th-19th Century): A long-term cycle driven by technological advancements such as the steam engine, mechanized textile production, and railways, which fundamentally altered production methods and economic structures.

- The Digital Revolution (1980s-Present): The rise of computers, the internet, and artificial intelligence has created a long-term structural shift in industries, jobs, and global markets.

- Impact on Businesses:

- Businesses must innovate and adapt to changing technologies and market demands.

- Industries that fail to keep pace with structural shifts risk obsolescence (e.g., the decline of Blockbuster due to digital streaming platforms like Netflix).

Comparing Short-Term and Long-Term Cycles

| Aspect | Short-Term Cycles | Long-Term Cycles |

|---|---|---|

| Duration | 2 to 10 years | 20 to 50 years or more |

| Drivers | Demand-supply imbalances, policy changes | Structural shifts (technology, demographics) |

| Economic Impact | Temporary fluctuations | Fundamental and transformative changes |

| Examples | Dot-com bubble, seasonal retail cycles | Industrial Revolution, Digital Revolution |

| Business Strategy | Adjust operations to stabilize in the short run | Innovate and adapt to long-term trends |

Economic cycles—or business cycles—are an inevitable part of economic activity. Understanding the phases, commonly used terms, and strategies for navigating them helps individuals and businesses make informed decisions. Whether managing growth in a boom or restructuring during a slump, strategic adaptability ensures success through every phase of the cycle.\

Mohsin Yaseen

On behalf of SolBizTech Team

Author of the article

https://www.linkedin.com/in/rmyasin