1. Cost Classifications in Managerial Accounting

I extend my sincere gratitude and acknowledgment to Dr. Farman Afzal, from the Institute of Business & Management (IB&M), UET Lahore, for his invaluable assistance and insights in shaping this knowledge. His expertise in Financial and Managerial Accounting has greatly enriched the content, making it more relevant to contemporary financial practices. This acknowledgment also highlights his continuous contributions to promoting awareness and fostering meaningful discourse on Corporate Social Responsibility (CSR), benefiting both the student and professional community.

For detail pl review the post

Managers classify costs in several ways depending on their purpose—whether it's controlling costs, preparing financial reports, or making strategic decisions. The main classifications from the book are:

I.Cost Traceability

Definition: Classifying costs based on whether they can be easily and economically traced to a cost object (e.g., a product, service, or department).

Direct Costs

- Definition: Costs that can be directly traced to a cost object.

- Examples:

- Direct materials (e.g., chocolate used in a candy bar).

- Direct labor (e.g., wages for workers who assemble the product).

- Use: Helps managers understand product or service costs to ensure pricing reflects true costs.

Indirect Costs

- Definition: Costs that cannot be traced directly to a cost object in a cost-effective way.

- Examples:

- Factory utilities or depreciation on production equipment.

- Supplies like nails or screws for assembly.

- Use: These are allocated to products or services using a predetermined rate.

II.Cost Behavior

Definition: Classifying costs based on how they behave relative to changes in production or activity levels.

Variable Costs

- Definition: Costs that change in direct proportion to the volume of activity.

- Examples:

- Raw materials (e.g., sugar used for candy).

- Sales commissions tied to the number of units sold.

- Use: Helps managers predict how costs will change with production levels.

Fixed Costs

- Definition: Costs that remain constant within a relevant range of activity.

- Examples:

- Factory rent, salaries of supervisors.

- Depreciation of machinery.

- Use: Important for break-even analysis and cost-volume-profit (CVP) analysis.

Mixed Costs

- Definition: Costs that have both fixed and variable components.

- Examples:

- Utility bills with a fixed service fee and a variable charge for usage.

- Use: Requires separation into fixed and variable components for decision-making.

III.Value-Adding vs. Non-Value-Adding Costs

Definition: Costs are assessed based on whether they add value to the product or service from the customer’s perspective.

Value-Adding Costs

- Definition: Costs that increase the product's or service's market value.

- Examples:

- Costs incurred to improve product quality or packaging.

- Labor directly used in production.

- Use: Helps identify areas where quality enhancements could justify a price increase.

Non-Value-Adding Costs

- Definition: Costs that do not increase market value but are necessary for operations.

- Examples:

- Administrative expenses.

- Costs related to inefficiencies (e.g., rework or waiting time).

- Use: Managers aim to minimize or eliminate these costs to improve efficiency.

IV.Cost Classifications for Financial Reporting

Definition: Costs are divided based on their treatment in financial statements.

Product Costs (Inventoriable Costs)

- Definition: Costs directly associated with manufacturing a product.

- Components:

- Direct materials: Raw materials traceable to the product.

- Direct labor: Wages of workers who directly manufacture the product.

- Overhead: Indirect costs (e.g., factory utilities, maintenance).

- Use: Reported as inventory on the balance sheet until the product is sold.

Period Costs

- Definition: Non-manufacturing costs incurred during an accounting period.

- Examples:

- Selling and administrative expenses.

- Office rent and salaries.

- Use: Expensed directly on the income statement in the period incurred.

V.Prime Costs and Conversion Costs

Definition: Costs grouped to highlight labor and material intensity.

Prime Costs

- Sum of direct materials and direct labor.

- Focuses on the primary costs of production.

Conversion Costs

- Sum of direct labor and overhead.

- Highlights the cost of converting raw materials into finished goods.

1.1. Cost Classifications Comparison

| Classification Type | Category | Definition | Examples | Uses |

|---|---|---|---|---|

| Cost Traceability | Direct Costs | Costs directly traceable to a specific cost object. | Raw materials, direct labor wages. | Determine product/service costs and pricing strategies. |

| Indirect Costs | Costs not conveniently or economically traceable to a cost object. | Factory rent, maintenance, utilities. | Allocate indirect costs using predetermined rates. | |

| Cost Behavior | Variable Costs | Costs that change in proportion to the level of activity. | Raw materials, sales commissions. | Forecast costs for budgeting and decision-making. |

| Fixed Costs | Costs that remain constant within a relevant range of activity. | Salaries, equipment depreciation. | Plan for fixed expenses and break-even analysis. | |

| Mixed Costs | Costs with both fixed and variable components. | Utility bills with a fixed service charge and variable usage. | Analyze cost structures and behavior for budgeting. | |

| Value-Adding vs. Non-Value-Adding | Value-Adding Costs | Costs that increase the product's or service's market value. | Product design, high-quality materials. | Enhance quality and justify higher prices. |

| Non-Value-Adding Costs | Costs that do not increase market value but may be necessary. | Administrative salaries, rework costs. | Minimize or eliminate to improve efficiency. | |

| Financial Reporting | Product Costs | Costs related to manufacturing and included in inventory. | Direct materials, factory depreciation. | Valued as inventory until sold. |

| Period Costs | Non-manufacturing costs expensed during the period incurred. | Office rent, selling expenses. | Expensed directly on income statements. | |

| Prime Costs vs Conversion Costs | Prime Costs | Sum of direct materials and direct labor costs. | Raw materials and wages of production workers. | Used to track the primary costs of production. |

| Conversion Costs | Sum of direct labor and overhead costs. | Wages of production workers and factory overhead. | Highlights conversion efforts in production. |

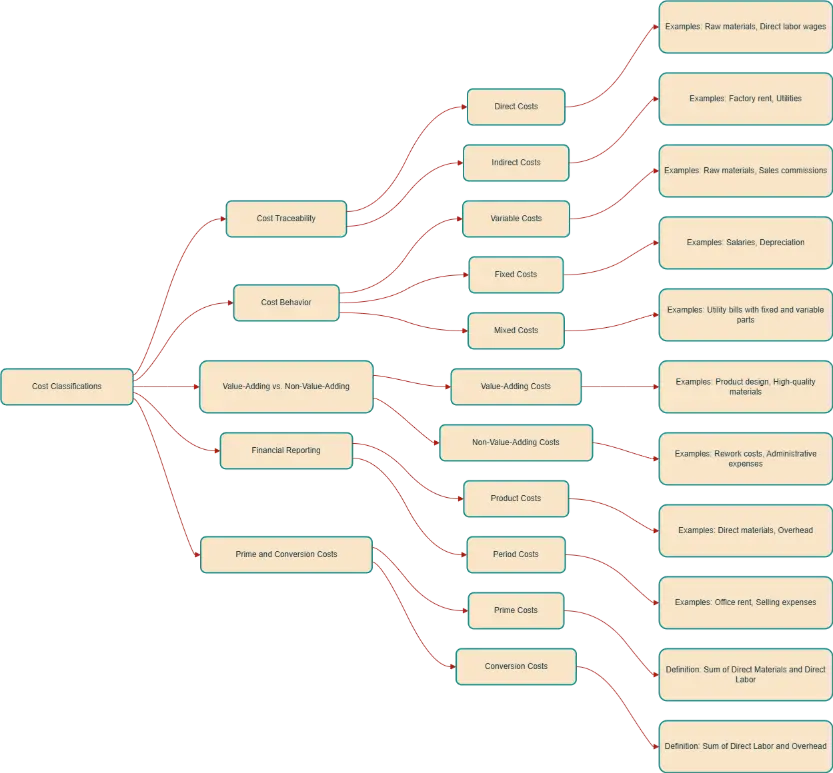

1.2. Cost Classification Presentation

2. Uses of Cost Classifications by Organizations

Service Organizations

- Focus on direct labor and service-related overhead.

- Example:An accounting firm tracks costs for preparing tax returns.

Retail Organizations

- Focus on merchandise costs and operational expenses.

- Example: A store tracks inventory costs and adjusts for freight-in or purchase discounts.

Manufacturing Organizations

- Categorize direct materials, direct labor, and overhead to track product costs.

- Example: A candy manufacturer determines the cost per unit by combining all these components.

| Organization Type | Focus Areas | Examples of Costs | Key Uses |

|---|---|---|---|

| Service Organizations | Direct labor, service-related overhead, and operational efficiency. | 1. Accountant labor costs for tax return preparation. 2. Office utilities and rent. 3. Cost of reporting forms. |

1. Estimate service costs for pricing and profitability. 2. Bid on new projects based on cost projections. 3. Drop unprofitable services after analysis. |

| Retail Organizations | Merchandise procurement costs, inventory control, and operational expenses. | 1. Inventory purchase costs (including discounts and freight-in). 2. Storage and handling expenses. 3. Costs of clearance and promotional pricing. |

1. Determine selling prices based on cost data. 2. Forecast gross margin and operating income. 3. Manage inventory valuation for financial reporting. |

| Manufacturing Organizations | Production costs, including direct materials, direct labor, and overhead allocation. | 1. Raw materials (e.g., chocolate for candy bars). 2. Direct labor wages (e.g., candy chefs). 3. Factory overhead (e.g., utilities, maintenance, depreciation). |

1. Compute cost per unit for pricing decisions. 2. Assess outsourcing opportunities for cost reduction. 3. Drop unprofitable product lines and improve production efficiency. |

3. How Managers Use Cost Classifications:**

Planning:

- Use cost classifications to budget and forecast expenses.

- Example: A manufacturer calculates how many units must be sold to cover fixed and variable costs.

Decision-Making:

- Evaluate make-or-buy decisions (e.g., outsourcing vs. in-house production).

- Example: Assessing whether to outsource the production of candy wrappers to reduce costs.

Performance Evaluation:

- Compare actual costs to budgeted costs to identify inefficiencies.

- Example: Analyzing overhead variances to find cost-saving opportunities.

Financial Reporting:

- Prepare financial statements by classifying costs as either product or period costs.

- Example: Recording direct labor as part of inventory on the balance sheet.

Example: Candy Manufacturing

Using a candy bar as an example:

- Direct Costs: Chocolate and sugar (direct materials), candy chef wages (direct labor).

- Indirect Costs: Utilities for running mixers, depreciation on factory machines.

- Value-Adding Costs: High-quality chocolate.

- Non-Value-Adding Costs: Idle machine time or inspection delays.

By systematically classifying costs, managers can make strategic decisions to enhance profitability, reduce inefficiencies, and maintain competitive pricing.

Example: University Lecture Delivery

| Cost Examples | Traceability to Product | Cost Behavior | Value Attribute | Financial Reporting |

|---|---|---|---|---|

| Professor's Salary | Direct | Fixed | Value-adding | Product (Direct Labor) |

| Classroom Utilities | Indirect | Variable | Value-adding | Product (Overhead) |

| Depreciation on Classroom Equipment | Indirect | Fixed | Value-adding | Product (Overhead) |

| Teaching Assistant's Stipend | Direct | Variable | Value-adding | Product (Direct Labor) |

| Marketing Expenses for Course Promotion | Not Traceable | Variable | Nonvalue-adding | Period |

| University Administrator's Salary | Not Traceable | Fixed | Nonvalue-adding | Period |

Author:

Mohsin Yaseen

On behalf of the SolBizTech Team

https://www.linkedin.com/in/rmyasin